MPC retains MPR at 13.5%, recommends privatisation of ‘dead’ assets

The Monetary Policy Committee (MPC) has retained the Monetary Policy Rate (MPR) at 13.5 per cent.

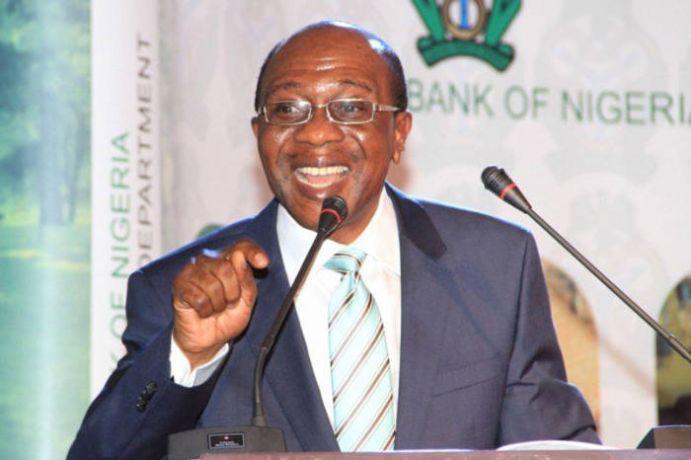

Mr Godwin Emefiele, the Governor of the Central Bank of Nigeria (CBN), disclosed this after the MPC meeting in Abuja on Friday.

Emefiele disclosed that nine out of 11 members of the committee attended the meeting.

He said the committee also retained Cash Reserve Ratio (CRR) at 22.5 per cent and the Liquidity Ratio at 30 per cent.

He explained that the development was a decision of the nine members of the committee who were in attendance at the meeting and voted unanimously for retention for the progress and development of the economy.

Emefiele said in considering specific policy options of whether to loosen, tighten or hold, the committee ensured that it focused and considered that the growth of the economy was imperative and the management of price stability was sacrosanct.

He disclosed that in consideration regarding the policy action to adopt, the MPC felt compelled to review as usual whether to tighten, hold or loosen.

According to him, tightening policy is not an option at this time, while loosening will drive growth in consumer credit without corresponding adjustment.

Emefiele said the option to hold required understanding of quantum and timing of liquidity injection into the economy before deciding on possible adjustment.

He said the committee also noted a positive moderation in inflation although slowly from 11.08 in July to 11.02 in August.

Meanwhile, the governor stated that the committee advised the government to adopt ‘big bank approach towards building fiscal buffer by purposefully freeing up redundant assets through efficient and effective privatisation process.

He said the step would raise fiscal revenue for the government and resuscitate redundant assets and also generate employment as well contribute to the growth of the economy. (NAN)