ENGINEERING ECONOMIC REFORMATION, BY ARIZE NWOBU

December 21, 2021

Economy is the lifeblood of a people. Citizens are happier and healthier mentally when the economy is buoyant, prosperous and with minimal inflation. But they are more frustrated and angrier, with greater prevalence of social vices under a harsh economy.

And that is why responsible governments and the relevant institutions do the best that they can to ensure a virtuous cycle of prosperity in their respective economies.

Central banks play pivotal roles in defining the trajectories and state of their respective homeland economies through the evolution of monetary policies and other necessary strategic initiatives which aim at fostering economic prosperity. It is noteworthy that central banks particularly have a phobia for inflation because it can destabilize an economy if it escalates beyond reasonable limits.

Hyperinflation can render currencies useless, chase away foreign investors and can even topple governments among other drastic consequences, as noted by experts. In view, central banks do all they can to tame inflation and keep it within reasonable brackets. They use different monetary tools to control the quantum of money inflow to the economy, and ensure the right quantity of inflow to keep the economy healthy.

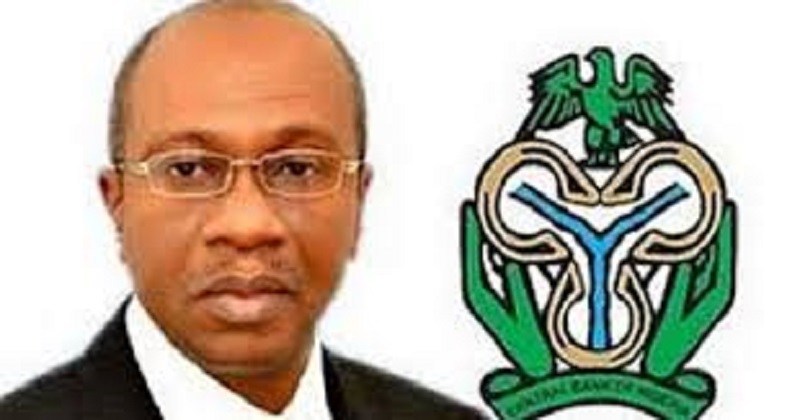

The Central Bank of Nigeria (CBN) under the present Governor, Mr Godwin Emefiele has been firing on all cylinders towards the reformation of the economy which was weakened and distorted especially after the implementation of the Structural Adjustment Programme (SAP) in 1986. SAP destroyed local manufacturing and degraded the economy to a heavily import-dependent economy, a development which largely contributed to the weakening of the naira and other aberrations in the economy.

CBN’s efforts aim at strengthening the fundamentals of the economy and resetting it on the right path for greater domestic productivity, reduced import-dependency, increased exports, diversification and greater stability. Mr Emefiele had noted that CBN could not afford to sit idly by and concentrate only on price and monetary stability, but that the Bank would take additional measures required towards identifying productive sectors of the economy and channeling credits towards these sectors.

The apex bank has continually complemented the efforts of the fiscal authorities by deploying several strategic interventions to promote macroeconomic stability and create an enabling environment with appropriate incentives to empower entrepreneurs to drive growth and development. The Bank has demonstrated creativity in policy evolution.

Creativity and innovation are germane in problem solving, and leads to higher overall success in organizations and economies. It is anticipated that the various initiatives will achieve their target objectives and culminate in the reformation of the economy in the long run. Because of the prolonged years of damage inflicted on the economy, the reformation will certainly not happen overnight. It will take some time if the efforts are sustained barring unforeseen circumstances such as the Covid-19 pandemic. CBN had noted that the economy was gradually recovering but that growth was still fragile and below par.

As the year 2021 comes to an end, it is necessary to highlight some of the major policies of CBN targeted at reforming and boosting the economy. The most recent is the ‘’100-for 100 Progamme’’ which aim at supporting the Federal Government’s efforts to boost productivity and diversify the economy. The Programme is a support to private sector companies with the aim of reducing certain imports, increasing non-oil exports and to improve the foreign exchange generating capacity of the economy.

It channels long-term funds to enterprises with potentials to kick start sustainable economic growth trajectory, accelerate structural transformation, promote diversification and boost productivity. The 100-for- 100 Programme offers a maximum sum of N5 billion per obligor.

CBN had earlier established the Real Sector Support Facility (RSSF) for the financing of Greenfield (new) and Brown field (new/expansion) projects in manufacturing and agriculture sectors only. The Facility is meant for the financing of projects in the two sectors, with high local content, foreign exchange earnings and potential for job creation. The maximum accessible facility is N10billion per project within a term of seven years and with two years moratorium.

Another policy initiative is the N400billion Targeted Credit for Households and Small and Medium enterprises. According to CBN, N370billion had been released to about 800 beneficiaries comprising 638,090 households and 128, 649 businesses.

Also, the Bank established the Tertiary Institutions Entrepreneurship Scheme (TIES) in partnership with Nigerian Polytechnics and Universities. The scheme aims to support entrepreneurial development among the youths in order to unleash their entrepreneurial potential and re-direct their focus from seeking white collar jobs to a culture of entrepreneurship.. TIES would provide access to finance bankable ideas by graduates and undergraduates towards tackling unemployment.

Earlier, CBN had promoted the Infrastructure Corporation of Nigeria (Infraco) in partnership with African Finance Corporation (AFC) and Nigerian Sovereign Investment Authority (NSIA) to raise over N15 trillion to support critical infrastructure. The role of infrastructure in accelerating economic transformation cannot be overemphasized. Infraco is expected to help in enabling greater private sector funding for public sector infrastructure in Nigeria.

Nwobu, a Chartered Stockbroker and Business Journalist wrote from Lagos. arizenwobu@yahoo.com. Tel 08033021230