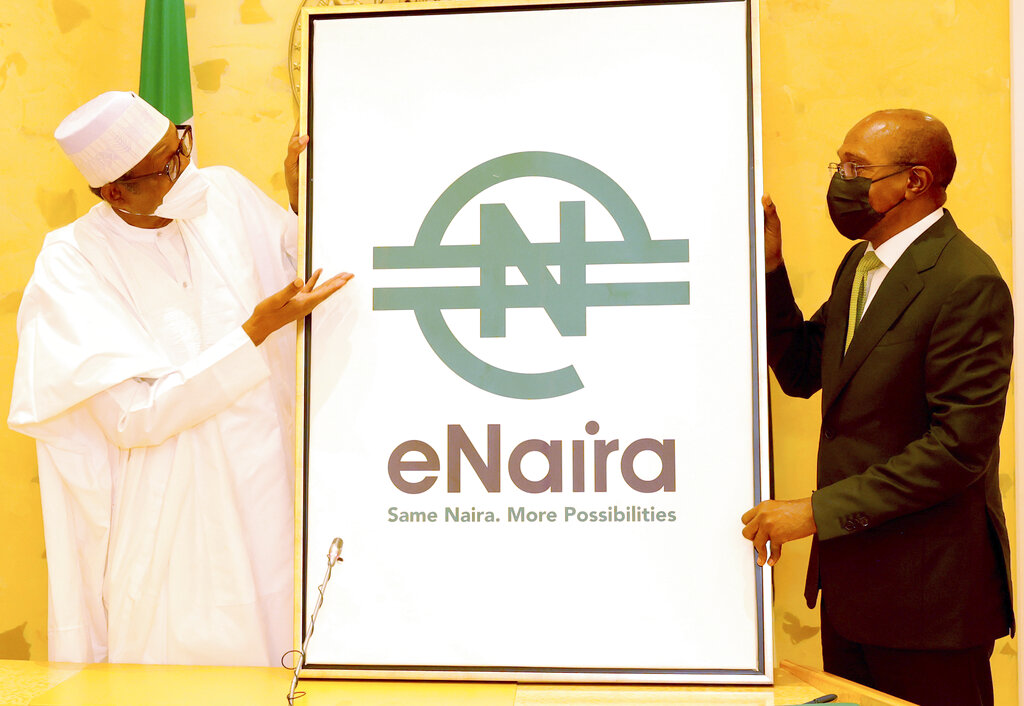

Emefiele scores a Bull’s eye with eNaira

OCTOBER 28, 2021

Central Bank of Nigeria, CBN, Governor, Godwin Emefiele, will go down in history as one of Nigeria’s most innovative CBN governors. Emefiele has introduced several initiatives to deepen the nation’s monetary sector, the latest being the eNaira. It’s simply a home-grown digital currency equivalent to the paper naira.

However, eNaira offers more possibilities, is less expensive to the owner as it is immune from several bank charges and it’s a boost to the cashless policy. The launch of the eNaira on Monday, October 25, is wrapped in history. For the record, it makes Nigeria the first ever African country to embrace the ewallet system of transaction. It places Nigeria on the same banking innovation pedestal with China and emerging markets like the Bahamas and Easter Caribbean.

On launch day, it already had 33 banks integrated into it, recording a daily hit of over 2.5 million visits to the website. With N200 million already issued to financial institutions and over 2,000 customers onboarded and over 120 merchants successfully registered on the platform at inauguration, it’s safe to say that CBN was properly primed for the digital experience.

One heartwarming fact is the issue of control. With eNaira, things cannot possibly go wrong because it gives CBN the leeway to exert a measure of control on the market to discourage abuses, fraud and sundry unforeseen happenstances that usually assail the fintech space. CBN deliberately built safeguards around the eNaira, thus making it a safer medium of financial transaction than the cryptocurrency.

Many Nigerians have been wondering what eNaira is all about. Some wondered how it would profit them. And for yet others, it’s just another elite fad to feed fat from the economy.

Put simply, eNaira is Central Bank Digital Currency (CBDC) and it is the digital equivalent of the physical Naira. It’s the same naira but offers far more possibilities and flexibility. And just like the physical Naira – it is a legal tender in Nigeria as well as a liability of the CBN. It will always exchange at 1 naira to 1 eNaira.

Its introduction was not an accident. It has a history. Recall that on February 5, this year, the CBN released a circular addressed to banks and other financial institutions. The circular bore one strong but inevitable message: It was a reminder that transactions in cryptocurrencies and facilitating payment for cryptocurrency exchanges had been prohibited. The CBN further directed all banks and other financial institutions to close the account of any person or entities that transact in cryptocurrency or operate cryptocurrency exchanges.

Not a few Nigerians spewed umbrage at CBN for dimming the light on a new fintech frontier where young Nigerians and others were already finding their bearing and reaping its full benefits. CBN promised to introduce a home-grown digital currency that Nigerians can trust, control and own. But CBN had good reasons to prohibit cryptocurrency. It is without borders, without control and liable to manipulation. But there was a bigger reason for the prohibition: Terrorists and their financiers have found a safe haven with cryptocurrencies to move money across borders and purchase firearms and other weapons of mass destruction to sustain their bloody war. Nigeria has been in the thick of terror attacks and anything done within the law to curtail the powers the terrorists is welcome. This was what won CBN public sympathy when it prohibited cryptocurrencies.

The recent conviction of some Nigerians in the United Arab Emirates (UAE) for being financiers of terrorism clearly justifies the action of CBN on cryptocurrencies. The eNaira is the fulfilment of the promise by CBN to come up with a digital currency that is amenable to regulation, trustworthy and conforms with Nigeria’s extant financial laws.

The benefits of eNaira are manifold. It will deepen the nation’s digital economy ecosystem. In recent years, Nigeria has broken new frontiers in the digital economy space. Whether in agriculture, healthcare, ecommerce, banking and education, appreciable progress has been made by the President Muhammadu Buhari government to mainstream Nigeria into the global digital economy matrix.

In 2020, in the heat of the covid-19 pandemic, Nigeria teamed up with six other countries to form the Digital Cooperation Organization (DCO). The founding member nations of DCO are Bahrain, Jordan, Kuwait, Nigeria, Oman, Pakistan and Saudi Arabia. The goal is to “drive greater collaboration and cooperation across entrepreneurship, innovation, business growth and employment in a shared digital economy.”

The shared values among the DCO nations include collaborative digital transformation that would enable member states to empower women, the youth and entrepreneurs within their jurisdictions.

The DCO target is essentially to accelerate growth across the digital economy, and achieve greater prosperity by promoting common interests and collaborative digital transformation. The CBN introduction of eNaira fits into menu of the DCO as it would ramp up Nigeria’s growing stature in the global digital economy market.

While launching the CBDC, President Buhari said it has the capacity to increase Nigeria’s Gross Domestic Product (GDP) by $29 billion over the next 10 years. The president acknowledged that there are Nigeria-specific benefits of the digital currency that cut across different sectors of the economy. He’s right. Nigeria, through the CBN cashless policy, has witnessed real growth in e-transactions across different sectors. The growth in the information communications technology (ICT) sector typified by pervasive use of mobile telephones, increasing broadband penetration, upsurge in computer deployment (especially laptops) in homes and offices has also boosted e-transactions.

Using physical cash to conduct businesses and make payments has been on the decline. It dipped further from 2020 at the onset of the Covid-19 pandemic thus birthing a new era of robust digital economy.

Cryptocurrency, despite the buzz and hype, has remained largely an artificial private currency which has built a huge cloud of doubt around itself. The very fact that not all nations of the world have embraced cryptocurrency says so much about the mistrust that still shrouds its operation.

This explains the growing number of central banks across the globe that are beginning to consider issuing digital currencies to assuage the hunger for such currency among their citizenry. Unlike cryptocurrency which lends itself to manipulation for all manner of unethical transactions due to little or zero regulation, reserve banks’ digital currencies are faster, safer, easier and cheaper means of payments. The issuer is known and regulation is certain. And with more countries rolling out their respective versions of digital currencies, cross-border trade and financial inclusion would be enhanced.

Thanks to Emefiele with support from President Buhari, Nigeria arrived here early. It’s a good place to be. It’s projected that within the next decade, national digital currencies would become the dominant player in the e-transaction ecosphere. Its seamless efficiency and ability to improve monetary policy operations across frontiers will make it the preferred in the coming years. The hesitancy that greeted cryptocurrency around the world will not afflict national digital currencies. Whereas cryptocurrency tend to compete with respective local currencies, CBDCs only complement local currencies. In Nigeria, the eNaira complements the physical naira.

CBDCs have the capacity to foster economic growth through better economic activities, increase remittances and improve financial inclusion. Nigeria is a heavy beneficiary of remittances, commanding one of the highest number of Diasporans in the world. The eNaira will play bigger role in managing Diaspora remittances.

The beauty of the eNaira is that it’s not hidden from the radar of CBN. Therefore, while helping to mainstream more people and businesses from the informal into the formal sector, it will ultimately boost the tax base of the country.

- Author: Jackson Olali, a policy analyst, writes from Yenagoa.