CBN to establish InfraCo Plc, plans N15trn take-off capital for infrastructure development

The Central Bank of Nigeria (CBN) says it will promote the establishment of InfraCo PLC with combined debt and equity take-off capital of N15 trillion to solely focus on infrastructure development as the country works towards mitigating the impact of COVID-19 on the economy.

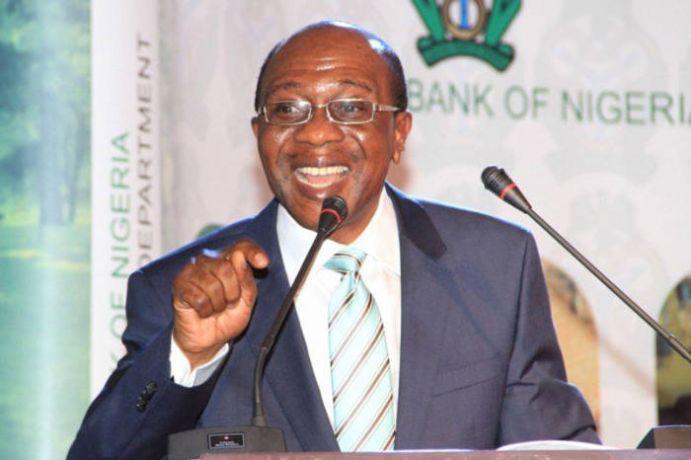

The Apex Bank Governor, Godwin Emefiele, in a 27-page policy response timeline document released on Tuesday, said a three-year strategic response is aimed at guiding through crisis management and rebooting the Nigerian economy.

Emefiele noted that the immediate-term policies would span an initial period of three months.

“The CBN has issued a support guideline on low-interest loans to hospitals and the pharmaceutical industry, to immediately deal with the public health crisis caused by the COVID-19 pandemic.

“Under this immediate-term response, we have activated financial system stability by granting regulatory forbearance to banks to restructure terms of facilities in affected sectors; triggered banks and other financial institutions to roll-out business continuity processes to ensure that banking services are delivered in a safe social-distance regime for all customers and bankers; grant additional moratorium of 1 year on CBN intervention facilities, and reduce interest rates on intervention facilities from 9 to 5 percent,” the CBN governor said.

He added that the 12-month short-term policy priorities which covers the establishment of InfraCo PLC, a world-class infrastructure development vehicle and a host of other initiatives will ensure that the value-added sector like the manufacturing industry, will be strengthened to reposition the Nigerian economic space.

“The CBN will pursue and reinvigorate the financial support for the manufacturing sector by expanding the intervention all through its value-chain and ensure that primary products sourced locally, provide essential raw material for the manufacturing sector except where they are only available overseas.

“With the support of the Federal Government, the CBN will embark on a project to get banks and private equity firms to finance homegrown and sustainable healthcare services that will help to reverse medical tourism out of Nigeria; by offering long-term financing for the entire healthcare value-chain (including medicine, pharmaceuticals and critical care), banks will work with the healthcare providers to consolidate on the current efforts to rebuild our medical facilities in order to ensure Nigeria has world-class affordable hospitals for the people of Nigeria and those wishing to visit Nigeria for treatment,” he added.

On a three-year projection, Mr Emefiele revealed that the CBN will act quickly to enable faster recovery of the economy for full business operation as the world returns to some new normal activities after taming the COVID-19 by a combination of vaccines and social distancing.

“In manufacturing, it is pertinent to note that Nigeria’s gross fixed capital formation is currently estimated at N24.55 trillion made up of residential and non-residential properties, machinery and equipment, transport equipment, land improvement, research and development, and breeding stocks. Of this estimated value, machinery and equipment, which are the main inputs into economic production, are currently valued at only N2.61 trillion.

“In order to pursue a substantial economic renewal, including replacement of at least 25 percent of the existing machinery and equipment for enhanced local production, we estimate at least N662 billion worth of investments to acquire high-tech machinery and equipment.

“Therefore, the CBN will consider an initial intervention of N500 billion over the medium term, specifically targeted at manufacturing firms to procure state-of-the-art machinery models that would fast-track local production and economic rejuvenation, as well as support increased patronage of locally processed products such as cement, steel, iron rods, and doors, amongst several other products.”

In the area of job creation, household incomes and economic growth, Mr. Emefiele stated that the bank will be focusing on bridging the housing deficit in the country by facilitating government intervention in three critical areas, housing development, mortgage finance and institutional capacity.