The Central Bank of Nigeria (CBN), has approved six dairy companies operating in the country for the importation of milk products and its derivatives.

The CBN made this known in a circular issued by the Director, Trade and Exchange Department, Dr. Ozoemena Nnaji in Abuja on Tuesday.

The bank listed the companies as FrieslandCampina WAMCO Nigeria, Chi Limited, TG Arla Dairy Products Limited, Promasidor Nigeria Limited, Nestle Nigeria PLC (MSK only) and Integrated Dairies Limited.

The bank explained that the development was in line with its objective to increase and improve the local production of milk, its derivatives and other dairy products in the country.

According to the circular which has taken effect, all Forms ‘M’ for the importation of milk and its derivatives by authorised dealers will only be allowed for the aforementioned companies.

Form ‘M’ is a mandatory statutory document to be completed by all importers for importation of goods into Nigeria.

It is therefore, mandatory for all importers to complete and register Form ‘M’ with Authorised Dealers at the time of placing orders whether the transaction is valid for foreign exchange or not.

The bank advised importers not on the list of companies cited in the circular to cancel all established Forms ‘M’ for the importation of milk and its derivatives for which shipment had not taken place.

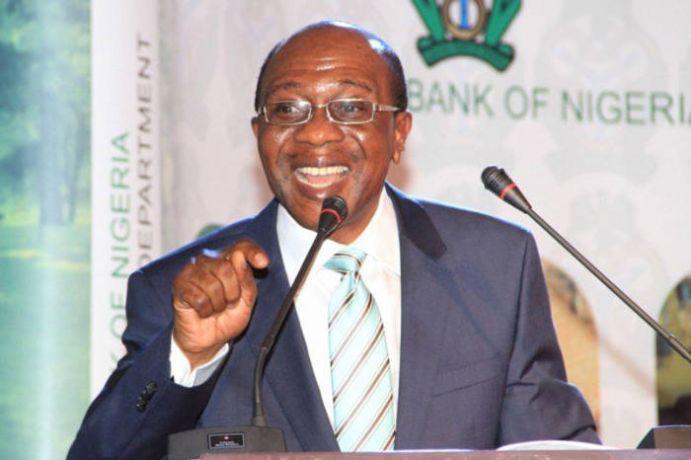

Speaking further on the intent of the circular, the CBN Director, Corporate Communications Department, Mr Isaac Okorafor explained that the bank engaged the six companies because they showed sufficient willingness and ability.

Okorafor said that those listed companies had adopted the CBN’s backward integration programme in order to enhance their capacity and improve local milk production.

He explained that the objective of the bank in that sector was to increase milk production in the country from the current figure of 500,000 metric tonnes to about 550,000 metric tonnes within the next 12 months.

In addition to facilitating easier access to funding for dairy investors, he said it was the bank’s desire to ensure that the country conserved foreign exchange, trigger economic growth and boost employment opportunities in the sector. (NAN)