Nigeria should mine from $3.3trn AfCTA – Adesina, calls Eco a ‘great idea’

President of the African Development Bank, Akinwunmi Adesina, has said that the biggest thing to happen to Africa is the African Continental Free Trade Area (AfCFTA), saying the free trade area itself is worth over 3.3 trillion dollars.

President of the African Development Bank, Akinwunmi Adesina, has said that the biggest thing to happen to Africa is the African Continental Free Trade Area (AfCFTA), saying the free trade area itself is worth over 3.3 trillion dollars.

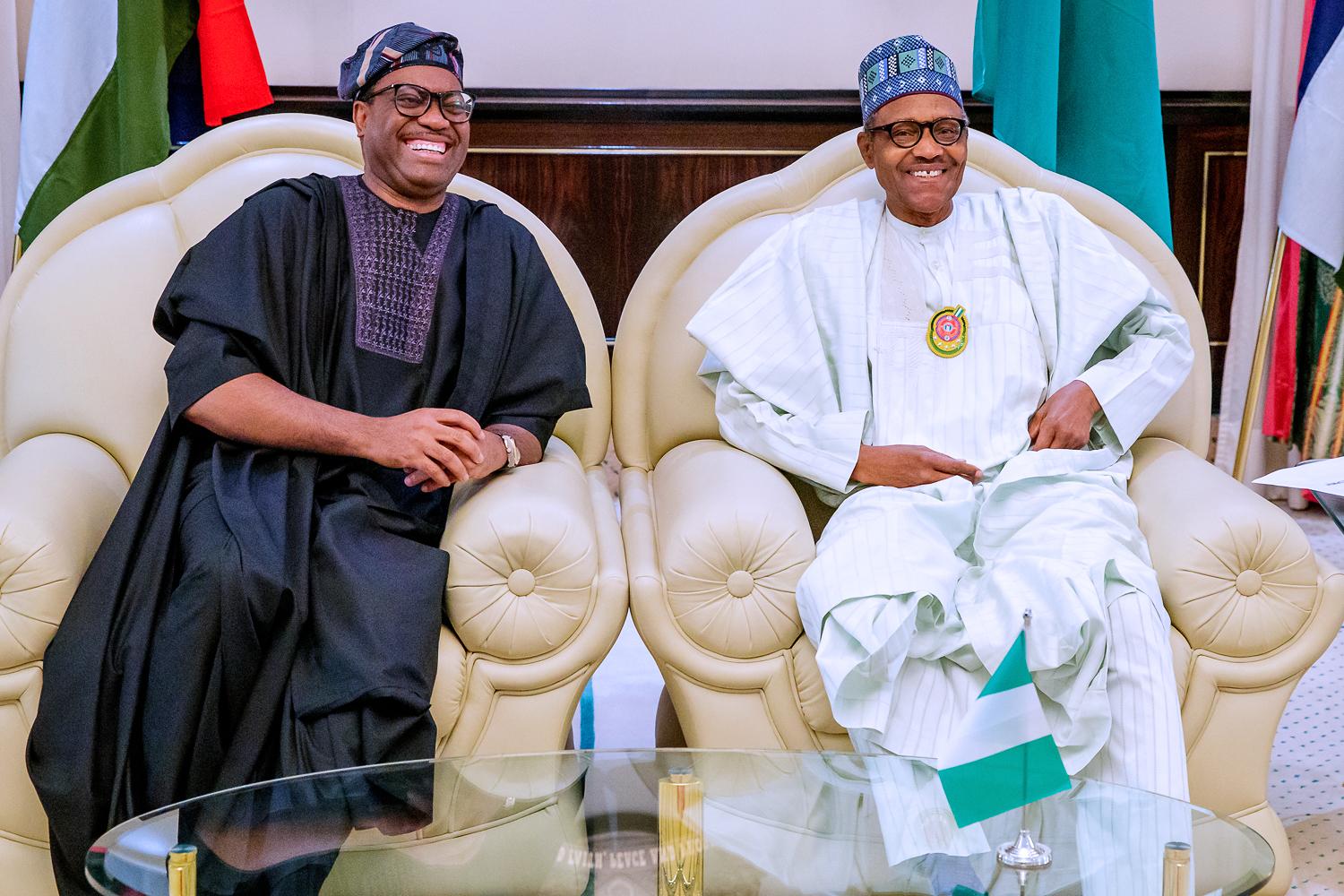

Adesina, who stated this when he addressed State House correspondents in Abuja on Tuesday, expressed the hope that the effective implementation of AfCFTA would transform the continent to a greater height.

He also supported the creation of a single currency by the Economic Community of West African States (ECOWAS), named ‘ECO’, describing it as a great idea.

”I think that at the end of the day the biggest thing to happen to Africa is the African Continental Free Trade Area (AfCFTA). That free trade area itself is worth over $3.3 trillion in terms of trade.

”Obviously being able to trade in various currencies, it’s not optimum to trade in so many currencies. So it makes common sense to have a unified currency and of course for that to even be achieved – the Eco, I support Eco greatly, I think it’s a great idea to do.

”But obviously, there are a number of convergence criteria that would have to be met and I am sure that our President is talking with other presidents to be sure that they can meet those criteria and the region can be fully integrated,” he said.

On infrastructure deficit in Nigeria, Adesina advised Nigerian government to invest its idle pension funds estimated at N9.56trillion for infrastructural revolution in the country.

According to him, African countries with over 1.8trillion dollars pension and sovereign wealth assets, can leverage on such huge resources to develop infrastructure on the continent.

He said: ”Africa countries have an infrastructure gap of between 68billion dollars to 108billion, which could be adequately addressed by utilising the 1.8trillion dollars accrued pension and sovereign wealth funds.”

The AFDB President urged African leaders to explore the possibility of spending the funds by investing in infrastructure development.

Adesina, while noting that “charity begins at home”, said with such huge resources, African governments have no need looking elsewhere to seek funds for development or investing the funds.

Adesina explained that with good infrastructure, Africa would be better positioned to compete favourably in trading with others.

According to Adesina, the bank is now better placed to continue to support the development of infrastructure across the continent,

He said: “Today, Africa has an infrastructure gap of about roughly 68billion dollars to 108billion dollars infrastructure financing gap. At the AfDB, we have been working so hard to close that particular gap.

”When it comes to the issue of attracting capital to do that, there are three things that I will say; first, we have to also look at home.

”Today, in Africa, the size of the sovereign wealth fund and pension fund and insurance pull of fund (mutual funds) is about 1.8trillion dollars.

“If we can just tap a little part of that, we will close very quickly the infrastructure gap that we are talking about. But, you see a lot of sovereign investment funds being invested in other sovereigns outside the continent.

“So, they become the sovereign wealth of others and then you go back and borrow back your own money; it doesn’t really make a lot of sense. I say that charity always begins at home.”