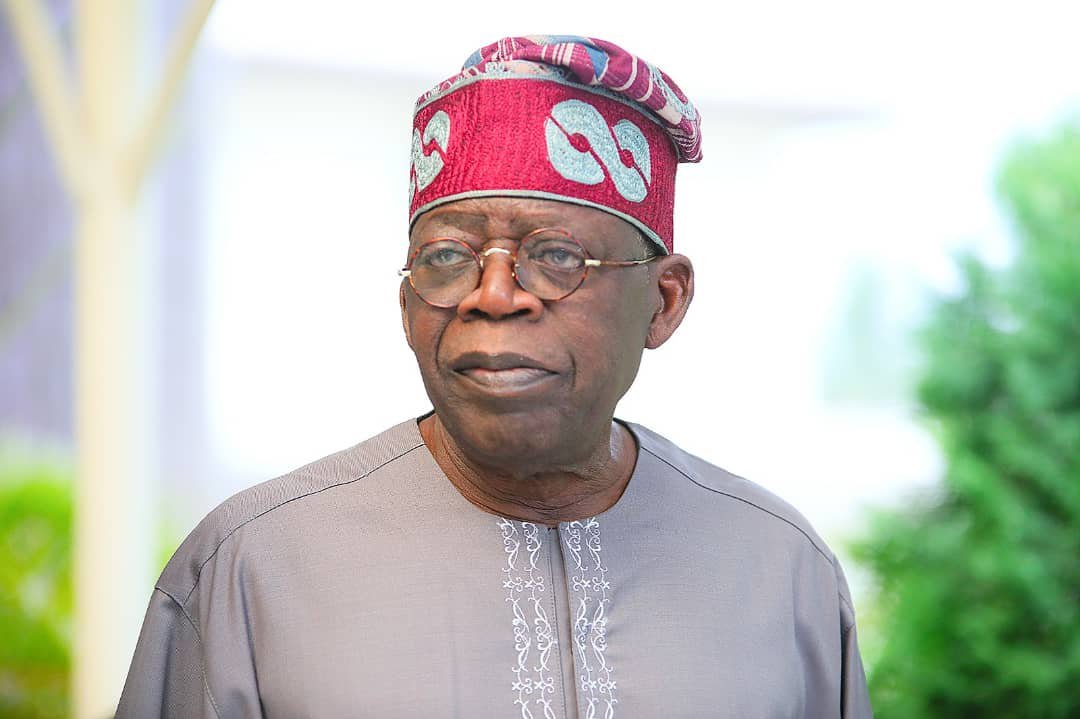

COVID-19: Tinubu urges FG, banks to reduce interest rates, provide Tax reliefs

The national leader of the All Progressives Congress (APC), Bola Tinubu, says the economic fallout from the coronavirus may present the best, most pressing case for revising the Central Bank of Nigeria’s, CBN, high interest rate policy.

Chief Tinubu in a lengthy communique on Sunday, titled: THE CASE AGAINST HIGH INTEREST RATES IN TIME OF CONTAGION: THE TIME IS NOW – CORRECT THE INTEREST RATE advised the Federal Government to also avail tax reliefs that would aid financial institutions in the country to reduce their interest rates.

According to the statement, he noted that by doing this, the government will saving the nation from a monumental drag on national economic growth.

He said lower rates will increase domestic investment and production, as well as create jobs.

“The economic fallout from the coronavirus may present the best, most pressing case for revising the CBN’s high interest rate policy. The undue rates penalise domestic investment and consumer borrowing. This reduces both aggregate domestic supply and, to a lesser degree, aggregate domestic demand”.

He added that lower rates may have some negative short-term impact on inflation and the exchange rate, the former governor of Lagos argued that the economic dislocations caused by the coronavirus will serve to mitigate those temporary negative consequences.

“We must retreat from high interest rates if we want investment borrowing to attain levels that actually increase private-sector growth and job creation”.

His Communique reads in part:

The chronic gap between domestic supply and demand has been filled by bloated levels of imports and encouraged an overvalued exchange rate that the high interests have helped produce. In normal times, the high interest rates also attract significant foreign financial speculation, the ever-ominous hot money.

While in the short-term, the foreign speculation boosts financial inflows. Over time, as compound interest payments become due on these foreign investments, the nation will lose an ever-increasing amount of money to satisfy foreign debt obligations.

In the short run, high rates seem to attract foreign capital and spur the economy while giving it discipline against inflation. In the longer-term, all of this is untrue. High rates give us the worst of both worlds. They stifle domestic investment and incomes while pushing up inflation and exposing an ever-increasing share of our financial system to foreign manipulation and dependence.

Put another way, if you take a single picture early in the process, the high interest rate policy looks good at that moment in time. However, if you view the entire movie, you will see an ending that is both painful and unnecessary.

The Central Bank of Nigeria has demonstrated its financial agility by establishing a growing number of special financing programs for various industries and sectors of the economy. While these programs look good at first glance, they also expose important contradictions in the CBN’s position.

The special schemes are an implicit admission that normal rates stifle investment borrowing and thus suppress the economy. The extraordinary schemes would not be required if the general interest rate was at a proper level. By establishing the special programs, the CBN attempts the impossible. On one hand it defends the general rate as prudent. On the other, it proliferates special exceptions in order to spur investment borrowing that the general rate has heretofore stifled.